The Loan Management system in TonaBank provides the admin with a complete set of tools to create, configure, and oversee loan services for customers. This module is designed to handle every aspect of the loan lifecycle — from creating flexible loan plans and setting up required documents to tracking installment progress and managing loan statuses. With powerful controls and detailed tracking, the admin can ensure the smooth and responsible management of all loan-related operations.

-

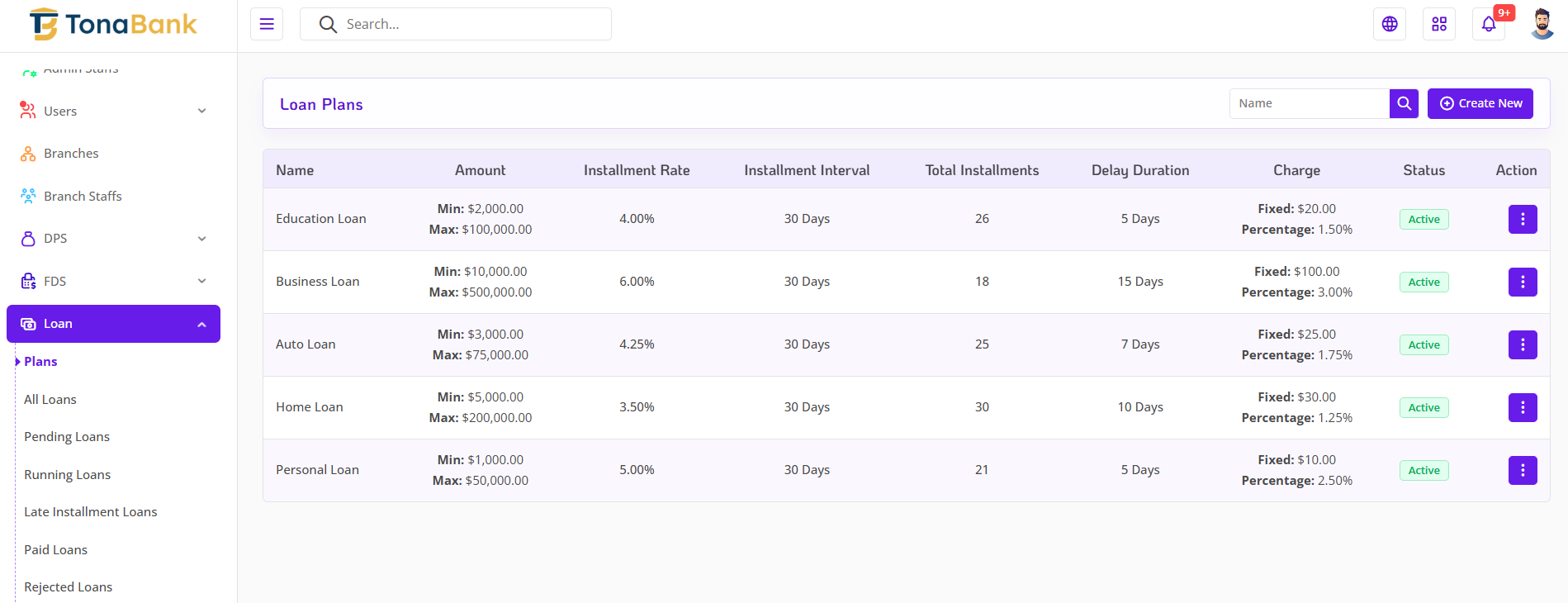

Create Loan Plans :

Admin will be able to create multiple Loan plans.

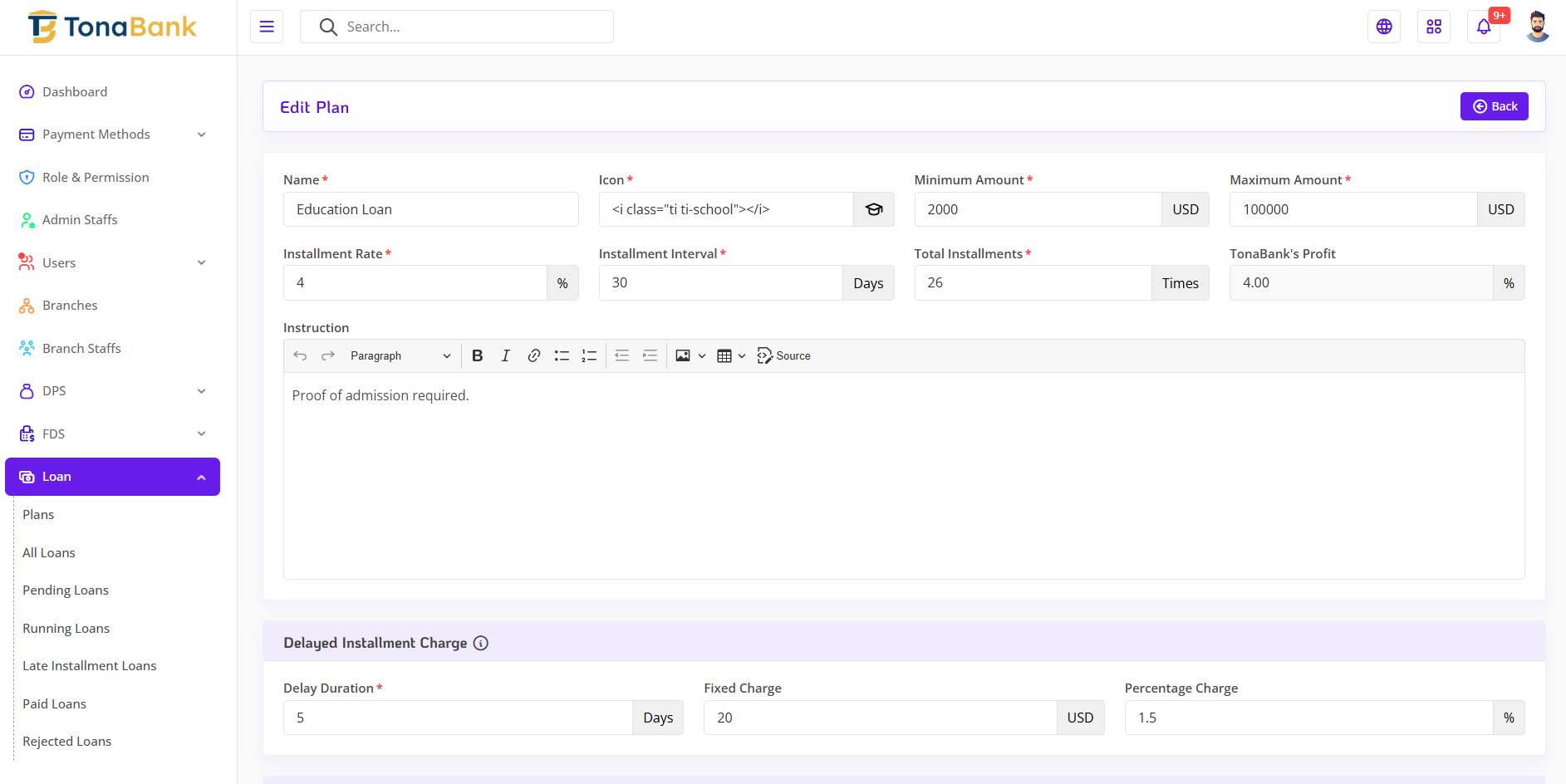

Define terms such as name, min max range, interest rate, duration, total number of installments rate.

Edit any loans plan details at any time.

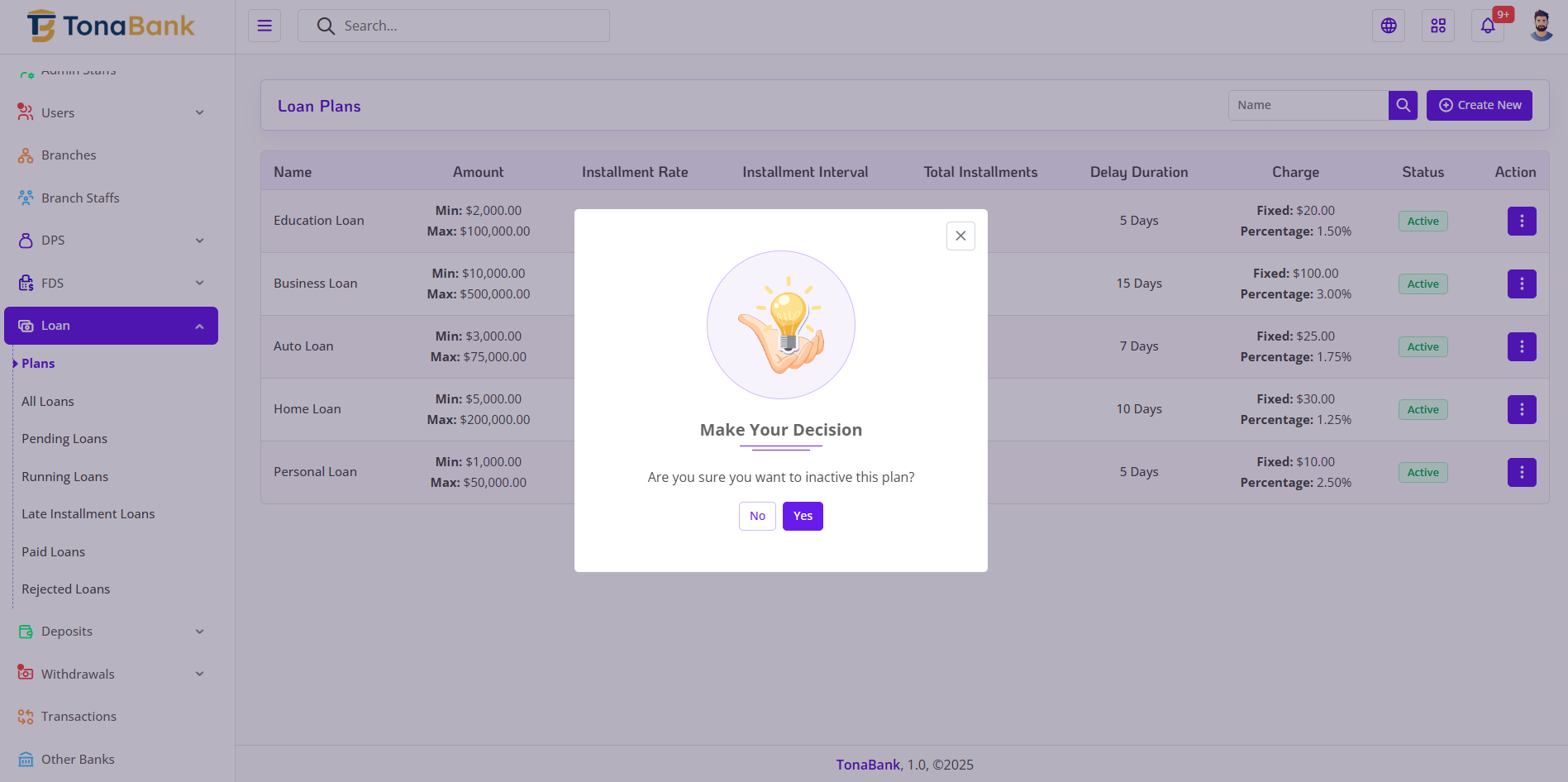

Set plans as active or inactive individually. -

Delayed Installment Charge Setup :

Admin will be able to set up delay charge system for each Loan plan

It will contain delay duration in days.

Fixed and percentage based charge system. -

Loan Application Requirements :

Set necessary questions that applicants must answer.

Define required proof documents for loan requests. -

Loan Overview and Monitoring :

View all loan accounts in one place

Admin will be able to see Running and Rejected loans.

Admin will be able to access detailed information on each account. -

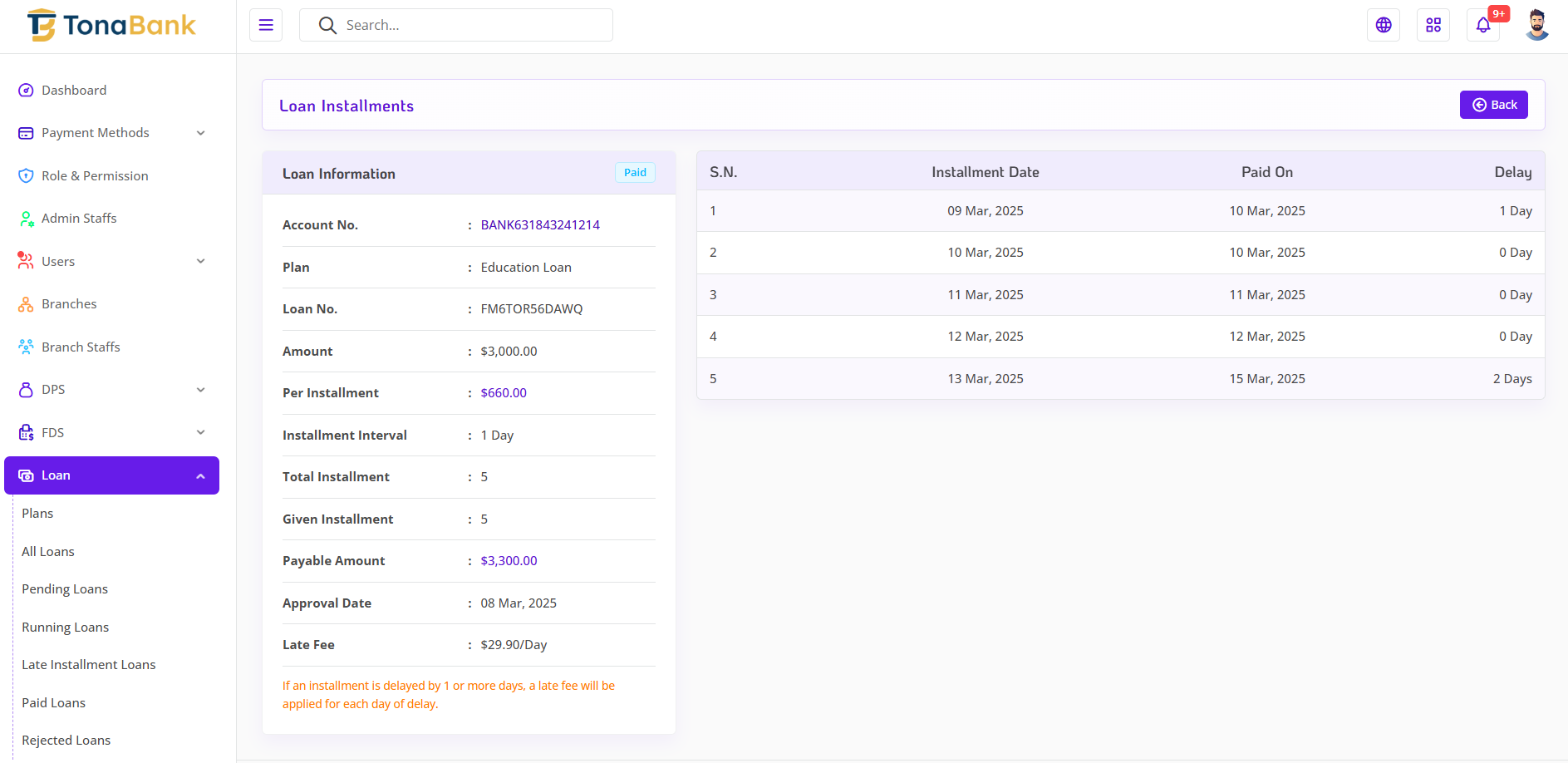

Installment Log Tracking :

See a complete log of each installment, including paid installment.

See a complete log of each installment, including remaining installment.

See a complete log of each installment, including next installment due dates.

The Loan Management feature in TonaBank delivers a comprehensive solution for administering loans, from creation to closure. By allowing flexible plan configuration, setting borrower requirements, and providing detailed installment tracking, the system empowers the admin to manage loans effectively and responsibly. This helps ensure smooth loan processing, better risk management, and enhanced customer service, ultimately supporting the bank’s financial goals and customer trust.

Loan - One

Loan - One

Loan - Two

Loan - Two

Loan - Three

Loan - Three

Loan - Four

Loan - Four